Latest Recommended

Fiat versus cryptocurrency currency

There was an era of fiat currencies and now it is considered to be that of cryptocurrencies like bitcoin. It all depends upon proper understanding of the types of currency system so as to determine life quality in future. To make our present and future… →Read more

Cryptocurrency Investment

Cryptocurrency investment refers to the practice of buying, holding, and selling digital currencies with the aim of making a profit. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

Investing in cryptocurrencies can be a high-risk, high-reward activity due to their volatility and lack of regulation. However, many investors believe that cryptocurrencies have the potential to disrupt traditional financial systems and offer new opportunities for investment and financial freedom.

To invest in cryptocurrencies, you need to first choose a cryptocurrency exchange that allows you to buy and sell digital assets. Then, you will need to create an account and link it to a bank account or credit card. Once you have funded your account, you can start buying cryptocurrencies such as Bitcoin, Ethereum, Litecoin, or any other digital asset available on the exchange.

It’s important to keep in mind that cryptocurrencies are highly volatile, and their value can fluctuate rapidly. Therefore, it’s crucial to do your research, analyze market trends, and create a sound investment strategy before investing in cryptocurrencies. Additionally, it’s important to understand the potential risks involved and to only invest what you can afford to lose.

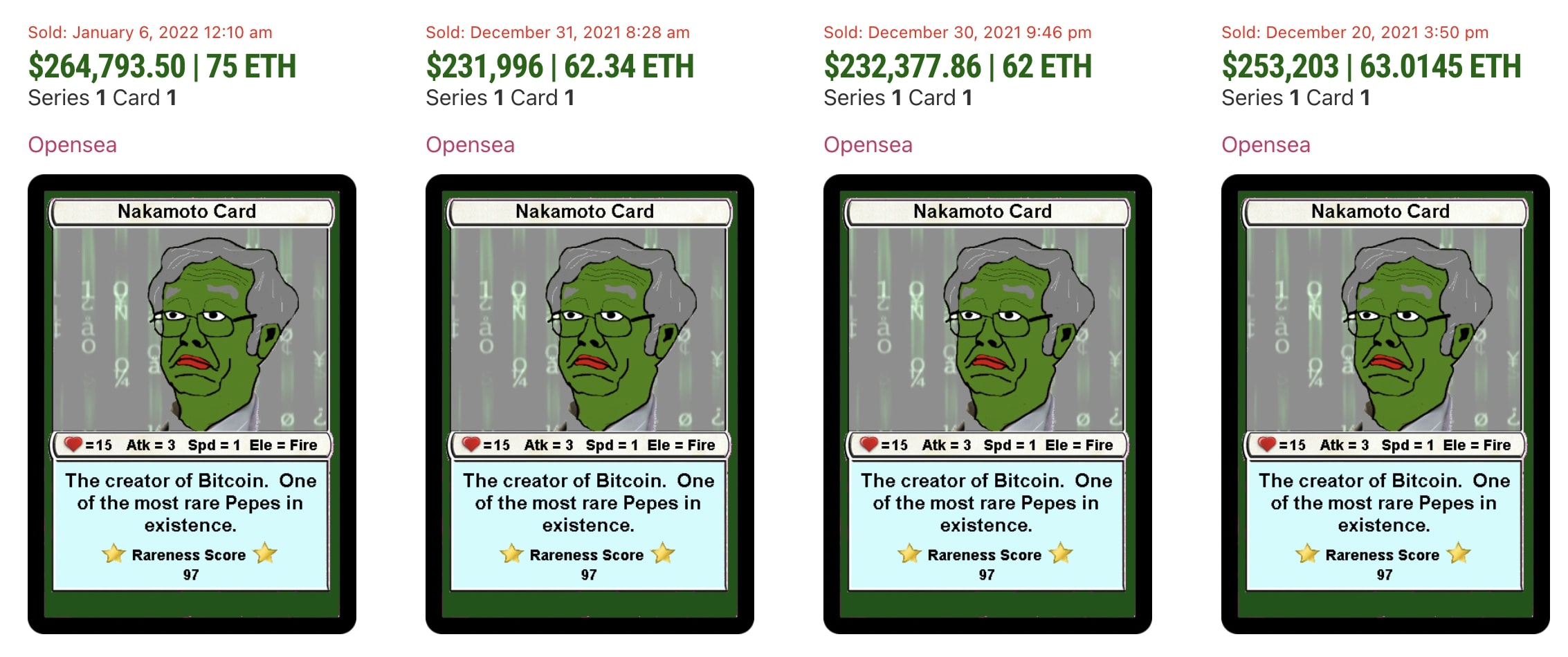

What is NFT? NFT definition (beginner) and example of use

What is an NFT? This is a question that many people ask themselves, when they are interested in topics around the Blockchain and Web3 in general. Let’s discover together how it works, and some examples of use cases today. NFT definition: non fungible token in English, or non fungible tokens in French NFTs are […] →Read more

5 examples of brands using NFT

Through technological changes or cultural phenomena, the modern world is constantly teaching us to broaden our horizons, to see things differently and to work in new ways. Companies are not sitting on the sidelines, they are exploring new ways of working to stay relevant and stand out in the market. If you follow trends, you’ve […] →Read more

NFT: our explanations to understand everything in a few minutes

What is an NFT? An NFT, or non-fungible token, is a unique token that certifies to its holder the ownership of a digital asset (collectible, video game item, digital artwork, etc.) or physical asset (artwork, real estate and many others). The acronym NFT stands for non fungible token and is therefore dissociated into two terms: […] →Read more

10 Amazing And Innovative Examples Of NFTs Everyone Should Know About

NFTs stepped into the limelight in 2021 with a number of projects achieving multi-million-dollar valuations and sales. But proponents of the blockchain-based tokens say that their true value goes beyond what super-rich collectors will pay for digital works of art. They have the potential to create entirely new classes of virtual assets as well as […] →Read more

How to Make Money with NFT

So, you’ve heard of NFTs and how some people have made money on them. NFTs are the latest cryptocurrency sensation to go mainstream. If you’re an entrepreneur or small business that creates some form of digital content, it makes sense for you to learn the ropes of making money through NFTs. You may have heard […] →Read more

How to Make Money with NFTs — 7+ Profitable Tips for 2023

Are looking to learn how to make money with NFTs? We will have you earning money from NFTs in no time with our detailed guide! After blowing away the internet in 2020, NFTs continue to be a major trend that everyone seems to be gushing over these days. You might have heard or read about […] →Read more

Investment

Investment refers to the act of allocating money or resources with the expectation of generating a profit or return on investment (ROI) over a specific period. The primary goal of investing is to put your money to work in a way that will help you achieve your financial goals, such as retirement, buying a house, or starting a business.

There are various investment options available, including short-term stocks,long-term stocks, bonds, real estate, mutual funds, exchange-traded funds (ETFs), commodities, and more. Each investment vehicle has its unique risk and return characteristics, which should be considered before investing.

Investing can be an excellent way to build wealth over time, but it’s essential to understand the risks involved and to have a well-thought-out investment strategy. Diversification is key to minimizing risk and maximizing returns, and it’s important to consult with a financial advisor or do thorough research before making any investment decisions.

Fiat versus cryptocurrency currency

There was an era of fiat currencies and now it is considered to be that of cryptocurrencies like bitcoin. It all depends upon proper understanding of the types of currency system so as to determine life quality in future. To make our present and future… →Read more

Obtaining a Car Title Loan: How Simple Is It?

This is a step by step informational guide for what you will need to apply for your car title loan. Getting a Car Title Loan with us has never being easier, our step by step guide shows you what is needed for your approval. Our car title loan… →Read more

The ABCs of Avoiding Car Burglaries

"I can still vividly picture the moment I drove into my home driveway late at night and saw my teenager’s car door wide open. Before I could even berate my daughter in mind for being so negligent, a man scampered out of the car empty-handed and… →Read more

Should I Invest in Bitcoin?

Over the past few months I have watched bitcoins value rise exponentially. I had no idea what bitcoin was and never even heard of crypto currency a few months ago. But with the recent government and media attention crypto currencies have received, they… →Read more

Buy stock photography or get a free download

While many people "right-click" and grab photographs from websites and social media, the quality and more importantly the ownership of those images is not the best for authors and designers. Here I will discuss the differences between the "right-click"… →Read more

Short-term Investment Stocks: Factors to Consider and Top Picks 2023

explore the characteristics of short-term investment stocks, the factors to consider when choosing them, and the top picks for investors looking to invest in the short-term market →Read more

Q&As

How to invest in crypto under 18 ?

Investing in cryptocurrency under the age of 18 can be challenging as most exchanges and platforms require users to be at least 18 years old. However, there are still a few options available:

Use a custodial account: Some cryptocurrency exchanges offer custodial accounts that allow minors to invest in cryptocurrency with the permission and supervision of their parents or guardians.

Use a peer-to-peer exchange: Peer-to-peer (P2P) cryptocurrency exchanges, such as LocalBitcoins, allow users to buy and sell cryptocurrencies directly with other individuals. This method may not require users to provide identification, making it possible for minors to participate.

Use a gift card or voucher: Some cryptocurrency exchanges and platforms, such as Paxful, allow users to purchase cryptocurrencies using gift cards or vouchers. Minors may be able to obtain gift cards from their parents or guardians to make purchases on these platforms.

It’s important to note that investing in cryptocurrency can be risky, and minors should only invest with the supervision and guidance of a trusted adult. Additionally, it’s essential to do thorough research before investing in any cryptocurrency and to understand the risks involved.

How does stock investing work

Stock investing is the process of purchasing stocks, or ownership shares in a publicly traded company, with the expectation of profiting from their future performance. Here are the basic steps of how stock investing works:

Research: Before investing in a stock, it’s important to do your research on the company, its financials, management, and industry trends.

Open a brokerage account: To buy and sell stocks, you’ll need to open a brokerage account. You can do this through a traditional brokerage firm or an online brokerage platform.

Choose your stock: Once you have done your research, you can choose the stocks you want to invest in based on your investment goals and risk tolerance.

Place your order: You can place an order to buy or sell a stock through your brokerage account. You can choose to buy a certain number of shares at a specific price or use a market order to buy or sell at the current market price.

Monitor your investment: After purchasing a stock, it’s important to monitor its performance regularly. This will help you determine when to buy, hold, or sell your shares.

Sell your shares: You can sell your shares anytime you want, either for a profit or a loss.

It’s important to note that stock investing comes with risks, including the potential for loss of principal. It’s important to have a well-diversified portfolio and not to invest more than you can afford to lose.