Non-Fungible Token (NFT): What It Means and How It Works

What Is a Non-Fungible Token (NFT)?

Non-fungible tokens (NFTs) are assets that have been tokenized via a blockchain. They are assigned unique identification codes and metadata that distinguish them from other tokens.

NFTs can be traded and exchanged for money, cryptocurrencies, or other NFTs—it all depends on the value the market and owners have placed on them. For instance, you could use an exchange to create a token for an image of a banana. Some people might pay millions for the NFT, while others might think it worthless.

Cryptocurrencies are tokens as well; however, the key difference is that two cryptocurrencies from the same blockchain are interchangeable—they are fungible. Two NFTs from the same blockchain can look identical, but they are not interchangeable.

Key Takeaways

- NFTs (non-fungible tokens) are unique cryptographic tokens that exist on a blockchain and cannot be replicated.

- NFTs can represent digital or real-world items like artwork and real estate.

- “Tokenizing” these real-world tangible assets makes buying, selling, and trading them more efficient while reducing the probability of fraud.

- NFTs can represent individuals’ identities, property rights, and more.

- Collectors and investors initially sought NFTs after the public became more aware of them, but their popularity has since waned.

Click Play to Learn All About Non-Fungible Tokens (NFT)

History of Non-Fungible Tokens (NFTs)

NFTs were created long before they became popular in the mainstream. Reportedly, the first NFT sold was “Quantum,” designed and tokenized by Kevin McKoy in 2014 on one blockchain (Namecoin), then minted and sold in 2021 on Ethereum.

NFTs are built following the ERC-721 (Ethereum Request for Comment #721) standard, which dictates how ownership is transferred, methods for confirming transactions, and how applications handle safe transfers (among other requirements). The ERC-1155 standard, approved six months after ERC-721, improves upon ERC-721 by batching multiple non-fungible tokens into a single contract, reducing transaction costs.

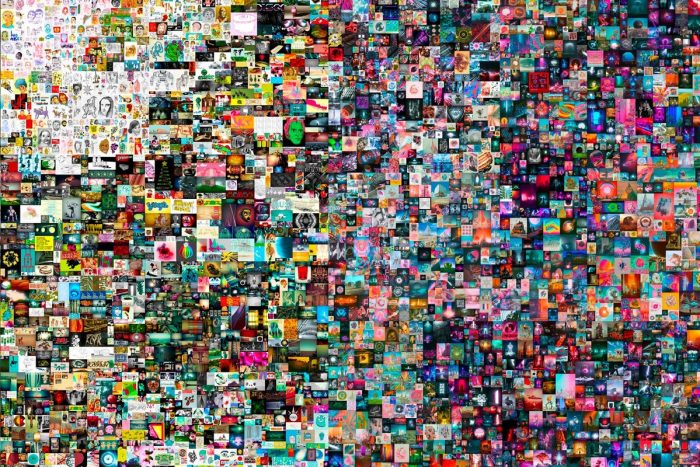

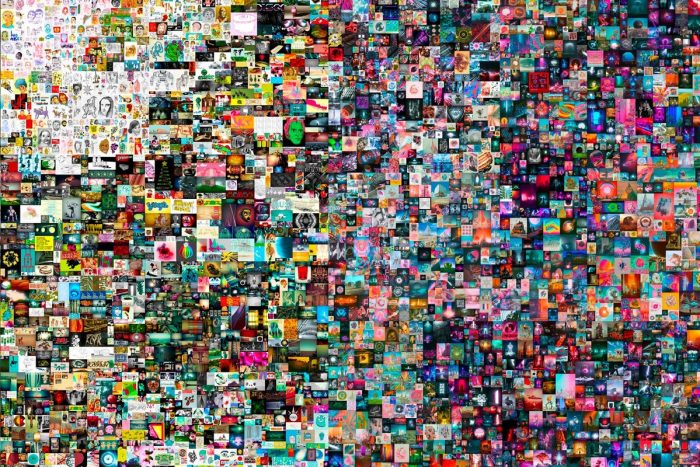

$69 million

In early March 2021, a group of NFTs by digital artist Beeple sold for over $69 million. The sale set a precedent and record for the most expensive digital art sold at the time. The artwork was a collage comprised of Beeple’s first 5,000 days of work.

How NFTs Work

NFTs are created through a process called minting, in which the information of the NFT is recorded on a blockchain. At a high level, the minting process entails a new block being created, NFT information being validated by a validator, and the block being closed. This minting process often entails incorporating smart contracts that assign ownership and manage the transferability of the NFT.

As tokens are minted, they are assigned a unique identifier directly linked to one blockchain address. Each token has an owner, and the ownership information (i.e., the address in which the minted token resides) is publicly available. Even if 5,000 NFTs of the same exact item are minted (similar to general admission tickets to a movie), each token has a unique identifier and can be distinguished from the others.

Blockchain and Fungibility

Like physical money, cryptocurrencies are usually fungible from a financial perspective, meaning that they can be traded or exchanged, one for another. For example, one bitcoin is always equal in value to another bitcoin on a given exchange, similar to how every dollar bill of U.S. currency has an implicit exchange value of $1. This fungibility characteristic makes cryptocurrencies suitable as a secure medium of transaction in the digital economy.

For this reason, NFTs shift the crypto paradigm by making each token unique and irreplaceable, making it impossible for one non-fungible token to be “equal” to another. They are digital representations of assets and have been likened to digital passports because each token contains a unique, non-transferable identity to distinguish it from other tokens. They are also extensible, meaning you can combine one NFT with another to create a third, unique NFT.

Examples of NFTs

Perhaps the most famous use case for NFTs is that of cryptokitties. Launched in November 2017, cryptokitties are digital representations of cats with unique identifications on Ethereum’s blockchain. Each kitty is unique and has a different price. They “reproduce” among themselves and create new offspring with other attributes and valuations compared to their “parents.”

Within a few short weeks of their launch, cryptokitties racked up a fan base that spent $20 million worth of ether to purchase, feed, and nurture them. Some enthusiasts even spent upward of $100,000 on the effort. More recently, the Bored Ape Yacht Club has garnered controversial attention for its high prices, celebrity following, and high-profile thefts of some of its 10,000 NFTs.

Much of the earlier market for NFTs was centered around digital art and collectibles, but it has evolved into much more. For instance, the popular NFT marketplace OpenSea has several NFT categories:

- Photography: Photographers can tokenize their work and offer total or partial ownership. For example, OpenSea user erubes1 has an “Ocean Intersection” collection of beautiful ocean and surfing photos with several sales and owners.

- Sports: Collections of digital art based on celebrities and sports personalities.

- Trading cards: Tokenized digital trading cards. Some are collectibles, while others can be traded in video games.

- Utility: NFTs that can represent membership or unlock benefits.

- Virtual worlds: VIrtual world NFTs grant you ownership of anything from avatar wearables to digital property.

- Art: A generalized category of NFTs that includes everything from pixel to abstract art

- Collectibles: Bored Ape Yacht Club, Crypto Punks, and Pudgy Panda are some examples of NFTs in this category

- Domain names: NFTs that represent ownership of domain names for your website(s)

- Music: Artists can tokenize their music, granting buyers the rights the artist wants them to have

Benefits of Non-Fungible Tokens

Perhaps, the most apparent benefit of NFTs is market efficiency. Tokenizing a physical asset can streamline sales processes and remove intermediaries. NFTs representing digital or physical artwork on a blockchain can eliminate the need for agents and allow sellers to connect directly with their target audiences (assuming the artists know how to host their NFTs securely).

Investing

NFTs can also be used to streamline investing. For example, consulting firm Ernst & Young has already developed an NFT solution for one of its fine wine investors—by storing wine in a secure environment and using NFTs to protect provenance.

Real estate can also be tokenized—a property could be parceled into multiple sections, each containing different characteristics. For example, one of the sections might be on a lakeside, while another is closer to the forest. Depending on its features, each piece of land could be unique, priced differently, and represented by an NFT. Real estate trading, a complex and bureaucratic affair, could then be simplified by incorporating relevant metadata into a unique NFT associated with only the corresponding portion of the property.

NFTs can represent ownership in a business, much like stocks—in fact, stock ownership is already tracked via ledgers that contain information such as the stockholder’s name, date of issuance, certificate number, and the number of shares. A blockchain is a distributed and secured ledger, so issuing NFTs to represent shares serves the same purpose as issuing stocks. The main advantage to using NFTs and blockchain instead of a stock ledger is that smart contracts can automate ownership transferral—once an NFT share is sold, the blockchain can take care of everything else.

Security

Non-fungible tokens are also very useful in identity security. For example, personal information stored on an immutable blockchain cannot be accessed, stolen, or used by anyone that doesn’t have the keys.

NFTs can also democratize investing by fractionalizing physical assets like real estate. It is much easier to divide a digital real estate asset among multiple owners than a physical one. That tokenization ethic need not be constrained to real estate; it can extend to other assets, such as artwork. Thus, a painting need not always have a single owner. Instead, multiple people can purchase a share of it, transferring ownership of a fraction of the physical painting to them. Such arrangements could increase its worth and revenues because more people can purchase parts of expensive art than those who can buy entire pieces.

How Can I Buy NFTs?

Many NFTs can only be purchased with ether (ETH), so owning some of this cryptocurrency—and storing it in a digital wallet—is usually the first step. You can purchase NFTs via any of the online NFT marketplaces, including OpenSea, Rarible, and SuperRare.

Are NFTs Safe?

Non-fungible tokens, which use blockchain technology like cryptocurrency, are generally impossible to hack. However, the weak link in all blockchains is the key to your NFT. The software that stores the keys can be hacked, and the devices you hold the keys on can be lost or destroyed—so the blockchain mantra “not your keys, not your coin” applies to NFTs as well as cryptocurrency. NFTs are safe as long as your keys are properly secured.

What Does Non-Fungible Mean?

Fungibility describes the interchangeability of goods. For example, say you had three notes with identical smiley faces drawn on them. When you tokenize one of them, that note becomes distinguishable from the others—it is non-fungible. The other two notes are indistinguishable, so they can each take the place of the other.

The Bottom Line

Non-fungible tokens are an evolution of the relatively simple concept of cryptocurrencies. Modern finance systems consist of sophisticated trading and loan systems for different asset types, from real estate to lending contracts to artwork. By enabling digital representations of assets, NFTs are a step forward in the reinvention of this infrastructure.

To be sure, the idea of digital representations of physical assets is not novel, nor is the use of unique identification. However, when these concepts are combined with the benefits of a tamper-resistant blockchain with smart contracts and automation, they become a potent force for change.

Investing in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.